|

|

Order by Related

- New Release

- Rate

Results in Title For file 1040 tax returns

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com .. |

|

| Non-filers of late tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you have delinquent tax returns, don ..

|

|

| This is a very simple application that goes deep and calculates the most tax refunds you are entitled to. Some of the returns you get might be unknown to you. Using this application you see all the refunds that are unique to you. .. |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained. ..

|

|

| This times the Penguin a disturbed man who was thrown in the sewer as child because of his deformity, and Cat woman a woman who went crazy after surviving a fall from a tall building lead the villains. .. |

|

| Quick playing strategy naval game enriched with multi-objective special missions using chess-like mix of battleship, destroyer, submarine, carrier, and other ships in turn-based action. Use classic naval maneuvers like destroyer against submarine to defeat the enemy, and create your own style of fleet tactics over time. Use rewards from previous battles to build customized flagships with a variety of unique abilities to give you an edge in crucial battles. Conquer predefined maps and innumerable randomly generated maps, controlling many aspects such as the map size, number of cities, resources, length of the battle, who has the upper hand as fighting starts, and other options. Build your own warships and then face surprises as the enemy fleet disposition gradually reveals itself. Tease the enemy artificial intelligence with feints, blockades, pinch-points, and sacrifice maneuvers on strategic and tactical levels. Even then, the game's AI is a vicious opponent, and you can choose from 11 levels of difficulty. Learn the game through four short tutorials that introduce you to the gameplay, tactics, strategy, and game interface. Battles initially focus on capturing and defending vital cities, and defeating the enemy warships in detail. Use the resources from cities you conquer to construct reinforcements at key shipbuilding cities throughout the battle. As you master the basics of the game, undertake the Save the Admiral Missions, adding a variety of concurrent unique struggles in the background such as keeping certain vital ships alive, destroying key enemy ships, or diverting ships to other war fronts. The game records a comprehensive history of all your battle victories and your progression through the ranks. After each battle you can post and compare your scores online and gain bonus assets for your next battle. Lost Admiral Returns includes a built-in updater program and links to forums, FAQ, and more so you will never miss the latest new fun stuff. ..

|

|

| Pac-Man is back with a New Millennium face life. Prepare yourself for over 60 Unique 3D Worlds including Donkey Kong Country and Bonus Levels. Choose from 5 different PacMan & Miss-PacMan Characters and enter Amazing 3D Worlds. .. |

|

| T-Minus Loved One Returns Countdown. Is someone special away from home? Whether they re on a personal or business trip, serving in the military, or away at college, now you can count down the time until they return. .. |

|

| Prepare yourself for over 60 Unique 3D Worlds including Donkey Kong Country and Bonus Levels. Choose from 5 different PacMan & Miss-PacMan Characters and enter 3D Worlds that include vertical scroll levels, power ups, power downs, ghost radar and much more. Also, the Music and True Voice Speech is out of this world. .. |

|

| Taxes stressing you out? Feel better by smacking around our virtual accountant. The more he takes out of your pocket the better you will feel after a good throwdown. .. |

|

Results in Keywords For file 1040 tax returns

| This is a very simple application that goes deep and calculates the most tax refunds you are entitled to. Some of the returns you get might be unknown to you. Using this application you see all the refunds that are unique to you... |

|

| This times the Penguin a disturbed man who was thrown in the sewer as child because of his deformity, and Cat woman a woman who went crazy after surviving a fall from a tall building lead the villains...

|

|

| T-Minus Loved One Returns Countdown. Is someone special away from home? Whether they re on a personal or business trip, serving in the military, or away at college, now you can count down the time until they return... |

|

| Non-filers of late tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you have delinquent tax returns, don..

|

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

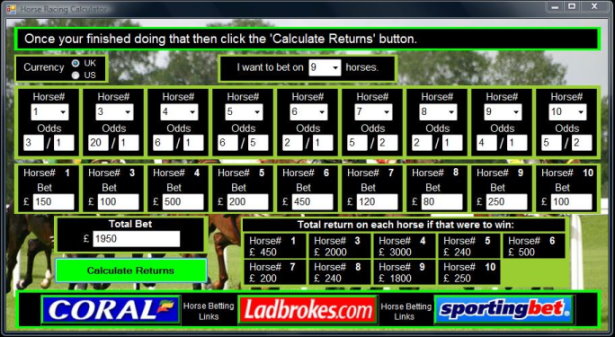

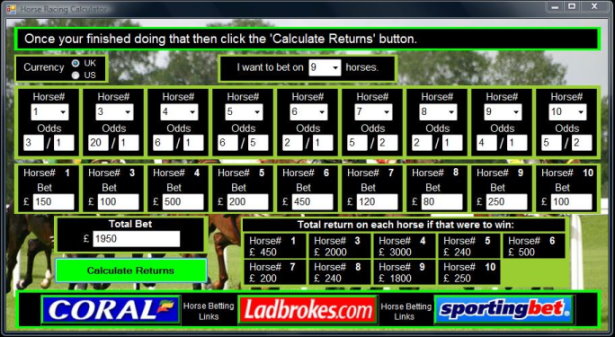

| A horse racing calculator for working out the returns on each horse in a race that you may want to bet on. Just enter the number of horses you want to bet on, their running numbers, their odds and the amount you want to place on each of them. then click the 'Calculate Returns' button to see the returns on each horse if that were to win...

|

|

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com.. |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

| SalesTax Mate is the ultimate Illinois sales tax preparation software.

Support for the following Illinois sales tax forms:ST1,ST2,ST4,ST8 or ST14.

Support for multi-location returns :SalesTax Mate takes the complexity out of creating returns for clients with multiple locations operating under the same Illinois Business Tax number.

E-mail or save returns in either Microsoft Word or PDF format.

Return history for each company.

Client instructions letter.

Support for all types of liability period.

Unlimited number of clients.

All forms generated by our sales tax software are approved by Illinois Department of Revenue... |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

Results in Description For file 1040 tax returns

| Tax Assistant for Excel is a custom application written for Microsoft Excel. It simplifies your Federal Income Tax preparation by providing Excel workbooks with IRS approved substitutes for both Form 1040, 1040A and related schedules.. |

|

| SalesTax Mate is the ultimate Illinois sales tax preparation software.

Support for the following Illinois sales tax forms:ST1,ST2,ST4,ST8 or ST14.

Support for multi-location returns :SalesTax Mate takes the complexity out of creating returns for clients with multiple locations operating under the same Illinois Business Tax number.

E-mail or save returns in either Microsoft Word or PDF format.

Return history for each company.

Client instructions letter.

Support for all types of liability period.

Unlimited number of clients.

All forms generated by our sales tax software are approved by Illinois Department of Revenue...

|

|

| JS@eTDS is an ideal software for generating your eTDS / eTCS Quarterly Returns as per the stipulated requirements of the Income Tax Department, Govt. of India. Submit your first quarter returns for the year 2011-12 using the software for free... |

|

| Tax Brackets Estimator is a tax planning tool. Tax Brackets Estimator displays your tax bracket, i.e. top tax percentage on the last dollar taxable income earned. The software includes tax information for year 2000-2005 and different filing status...

|

|

| Delete does not mean erase. "Previously deleted" files can be easily recovered. Use FastWiper to prevent file recovery and remove sensitive data such as tax returns, financial statements, passwords, health records, email and all evidence of your online activity. .. |

|

| This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2008. It includes an option of different filing status and shows average tax - the percentage of tax paid relatively to your total income...

|

|

| Tax Brackets Calculator displays tax brackets for federal income tax years 2000-2005, calculates you federal tax given your taxable income and estimates average tax rate... |

|

| Smart Investor's Calculator (SIC) allows users to find optimal investment portfolios through solving allocation problems with the selected criterion and restrictions on shares of investment in each instrumentgroup. In other words, SIC helps investors to find investment portfolios that, maximize returns and limit risks.A user may choose to maximize a pre-tax or post-tax rate of return on a portfolio, subject to restrictions.. |

|

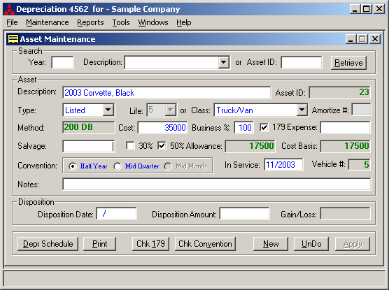

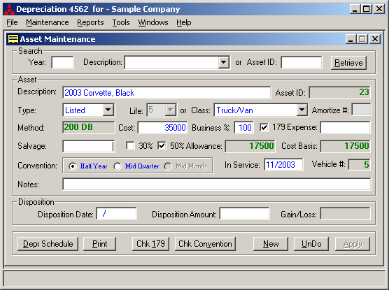

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

| This is a very simple application that goes deep and calculates the most tax refunds you are entitled to. Some of the returns you get might be unknown to you. Using this application you see all the refunds that are unique to you... |

|

Results in Tags For file 1040 tax returns

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained...

|

|

| Non-filers of tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. If you have delinquent tax returns, don't wait another minute; delay could cost you your freedom.The InfoNowBrowser (tm) is self-contained... |

|

| Tax Assistant for Excel is a custom application written for Microsoft Excel. It simplifies your Federal Income Tax preparation by providing Excel workbooks with IRS approved substitutes for both Form 1040, 1040A and related schedules..

|

|

| This is a very simple application that goes deep and calculates the most tax refunds you are entitled to. Some of the returns you get might be unknown to you. Using this application you see all the refunds that are unique to you... |

|

| Delinquent tax returns? You need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you are a IRS non-filer, don't wait another minute; delay could cost you your freedom.

Even if you believe that you have paid all the taxes you owe through withholding, or by your employer, the willful failure to file a return is a criminal offense. The best way to avoid criminal prosecution relating to late tax returns is to remedy the situation voluntarily and submit all unfiled tax returns. The IRS is far less likely to pursue a criminal prosecution if you take the first steps in resolving the issue and get all delinquent tax returns filed.

The InfoNowBrowser (tm) is a self-contained secure method of delivering text, video and audio information.

www.4taxhero.com..

|

|

| SalesTax Mate is the ultimate Illinois sales tax preparation software.

Support for the following Illinois sales tax forms:ST1,ST2,ST4,ST8 or ST14.

Support for multi-location returns :SalesTax Mate takes the complexity out of creating returns for clients with multiple locations operating under the same Illinois Business Tax number.

E-mail or save returns in either Microsoft Word or PDF format.

Return history for each company.

Client instructions letter.

Support for all types of liability period.

Unlimited number of clients.

All forms generated by our sales tax software are approved by Illinois Department of Revenue... |

|

| America's #1 efile tax software! Free tax preparation. No rebate gimmicks. Only $24.95 if you choose to efile your federal return and your state is free. You may also choose to receive your refund in as little as 24 hours. All active military personnel can efile their federal & state return for free. We don't offer hidden fees or tricks. We offer safe, affordable & fast tax preparation & efiling... |

|

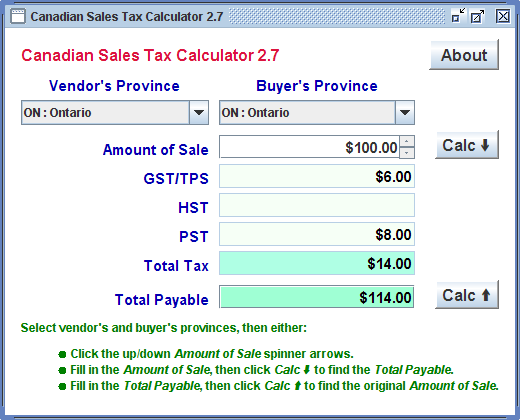

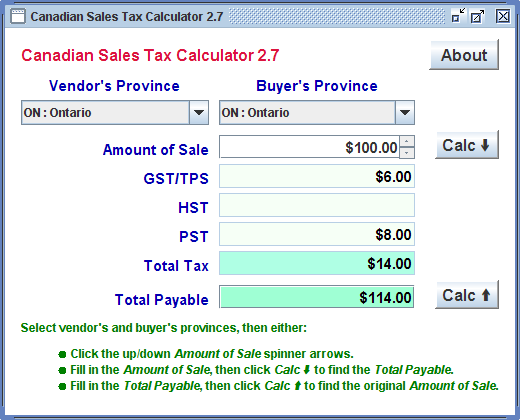

| Calculates Canadian sales taxes: GST HST and PST. Works either as an application or as an Applet that needs to run in JDK 1.3+ capable browser... |

|

| Non-filers of late tax returns need to act quickly to avoid criminal prosecution for failure to file a tax return. Tax Attorney David Jacquot, JD, LLM, P.A. can help nonfilers remedy their failure to file tax returns. If you have delinquent tax returns, don.. |

|

Related search : ax returnscriminal prosecutionunfiled tax,avoid criminal prosecutiontax returnscriminal prosecution,avoid criminal prosecutionassistant fortax assistant,tax returns calculatortax returnsdelinquent taxcriminal prosecution,avoid criminal prosecutiontaxOrder by Related

- New Release

- Rate

amended tax returns -

tax returns calculator -

copies old tax returns -

free tax returns -

last year tax returns -

|

|